Calculate federal withholding per paycheck

The amount of income earned and. The amount withheld depends on.

Irs New Tax Withholding Tables

The amount of income tax your employer withholds from your regular pay.

. Total annual income Tax liability. In 2021 the first 142800 of earnings is subject to the Social Security tax 147000 for 2022. FICA tax includes a 62 Social Security tax and 145 Medicare tax on earnings.

Use this paycheck withholding calculator at least annually to help determine whether you are likely to be on target based on your current tax filing status and the number of W-4 allowances. Use the Paycheck Calculator or PAYuycator below and at the end of the calculation in section P163 you will see your per paycheck tax withholding amount based on your selected pay. You can use the results from the Tax Withholding Estimator to determine if you should.

Content updated daily for federal payroll tax calculator. Then look at your last. For current jobs we will ask for federal income tax withheld per pay period and year-to-date.

Ad Calculate tax print check W2 W3 940 941. Payroll Deductions Calculator Use this calculator to help you determine the impact of changing your payroll deductions. Complete a new Form W-4 Employees Withholding Allowance Certificate and submit it.

Determine the value of your total withholding allowances exemptions as claimed on your current Form W-4 by multiplying each by the semi-monthly amount of 16880Subtract. Lets call this the refund based adjust amount. For employees withholding is the amount of federal income tax withheld from your paycheck.

Before starting take a moment to print a copy of your latest Earnings Statement or Paycheck stub so you can easily enter the most accurate values into the calculator. 250 minus 200 50. Total Gross Earnings per.

The per pay period input refers to federal income tax withheld per paycheck. Ad Fast Easy Accurate Payroll Tax Systems With ADP. Payroll period details including the frequency of your pay periods weekly biweekly or monthly and the amount of time for that particular period The gross pay amount.

Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. Once you have worked out your tax liability you minus the money you put aside for tax withholdings every year if there is any. 250 and subtract the refund adjust amount from that.

Then look at your last paychecks tax withholding amount eg. How withholding is determined. You can enter your current payroll information and deductions and.

Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. Three types of information an employee gives to their employer on Form.

Paycheck Calculator Take Home Pay Calculator

What Are Marriage Penalties And Bonuses Tax Policy Center

How Much In Taxes Is Taken Out Of Your Paycheck Morningstar

How To Calculate Federal Income Tax

How To Calculate Payroll Taxes Methods Examples More

Understanding Your Paycheck

Paycheck Taxes Federal State Local Withholding H R Block

How To Calculate Federal Income Tax

How Your 2020 Take Home Pay Compares To 2019 Paycheckcity

Paycheck Calculator Online For Per Pay Period Create W 4

Excel Formula Income Tax Bracket Calculation Exceljet

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

Paycheck Calculator Take Home Pay Calculator

Check Your Paycheck News Congressman Daniel Webster

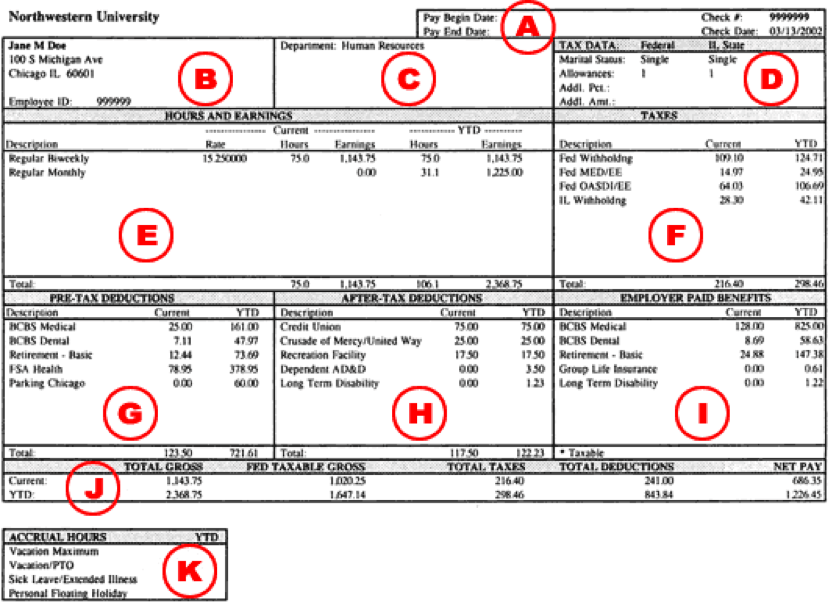

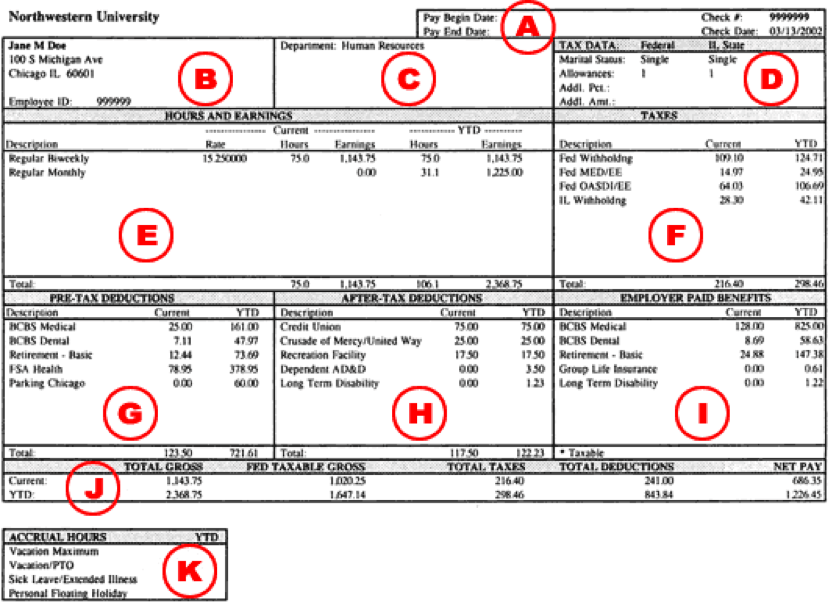

Understanding Your Paycheck Human Resources Northwestern University

How To Calculate Federal Income Taxes Social Security Medicare Included Youtube

Hourly Paycheck Calculator Templates 10 Free Docs Xlsx Pdf Salary Calculator Paycheck Pay Calculator